Invoices are important in the business world today. They are not just a means of getting paid for your products or services, but they are also an excellent opportunity to market your business and build customer loyalty, hence serving as a valuable marketing tool for your business.

In this article, I would be showing you how to create a professional invoice that perfectly reflects your brand identity, best practices for invoices (what and what not to include in an invoice), and also how to save time and generate professional invoice templates that would be perfect for your brand.

1. The benefits of well-Designed invoices for businesses

A well-designed and professional-looking invoice can help reinforce your brand identity and make your business look more professional and trustworthy. This can help promote your brand and leave a lasting impression on your customers.

It can also provide an opportunity to upsell your products or services by including promotional messages, discount offers, and so on. Invoices are also a great way to build customer loyalty by showing that you value your customers’ time and money. A clear and concise invoice can help your customers feel more confident in doing business with you and are more likely to return to you for future purchases.

One of the primary benefits of invoices is their role in financial record-keeping. Invoices provide a summary of the goods or services sold, the price, payment terms, and other important details that help businesses keep accurate financial records. This information can be used to track income, expenses, and profits, making it easier to manage your finances and plan for the future.

In addition to record-keeping, invoices also provide payment verification for both the buyer and seller. By outlining the payment terms and conditions, invoices can help avoid payment disputes or discrepancies and ensure that both parties are on the same page.

They also play a significant role in tax compliance. They provide the necessary information required for calculating and reporting taxes, helping businesses ensure that they pay the correct taxes on time.

2. Components of a professional invoice

2.1 – Invoice header

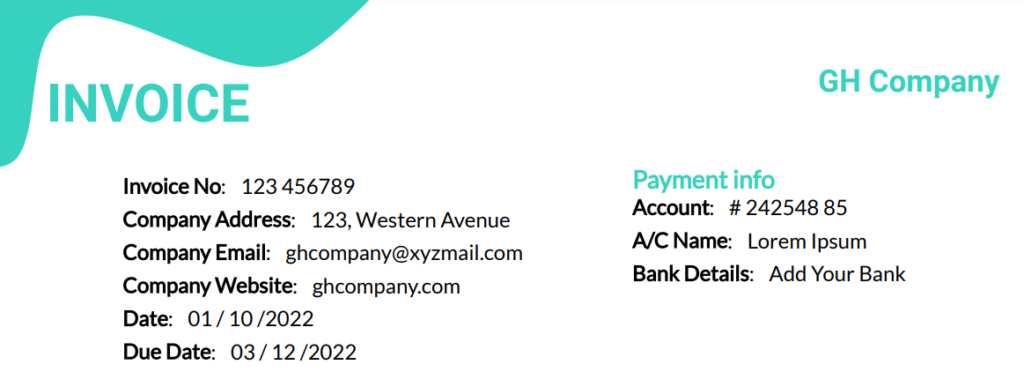

An invoice header is the top section of an invoice that contains critical information about the invoice, such as the company’s name, address, phone number, email address, and the details of the seller and buyer. It provides an overview of the invoice and helps identify it from other invoices.

To ensure that your invoice header is effective, it should include the following details:

- Company name: A company’s name in an invoice header can help to build brand recognition and credibility. By prominently displaying the company’s name on the invoice, it reinforces the company’s identity and promotes brand awareness. This can be particularly important for small businesses that are looking to establish themselves in a competitive market.

- Company address: Adding a company’s address in an invoice header is an essential component of the invoicing process for several reasons. It helps to identify the physical location of the seller or buyer. This is particularly important for businesses that operate across multiple locations, as it ensures that the invoice is directed to the correct office or department.

- Company email and website: Adding a company’s email address and website in an invoice header is an important part of the invoicing process for several reasons. It provides the buyer with multiple ways to contact the seller. It also ensures that the buyer has a direct and reliable way to contact the seller if they have any questions or concerns regarding the invoice. Adding the company’s website also provides a convenient way for the buyer to access additional information about the seller, such as product or service offerings, business hours, and contact details.

- Invoice date: Adding an invoice date in an invoice header is an essential component of the invoicing process for several reasons. The invoice date helps to establish the date on which the goods or services were provided to the buyer. This is important for record-keeping and accounting purposes, as it ensures that transactions are properly documented and can be easily tracked over time.

Invoicing is a critical aspect of any business, and having a clear and comprehensive invoice header is essential for ensuring that transactions are properly documented and that payments are processed efficiently

2.2 – Billing Information

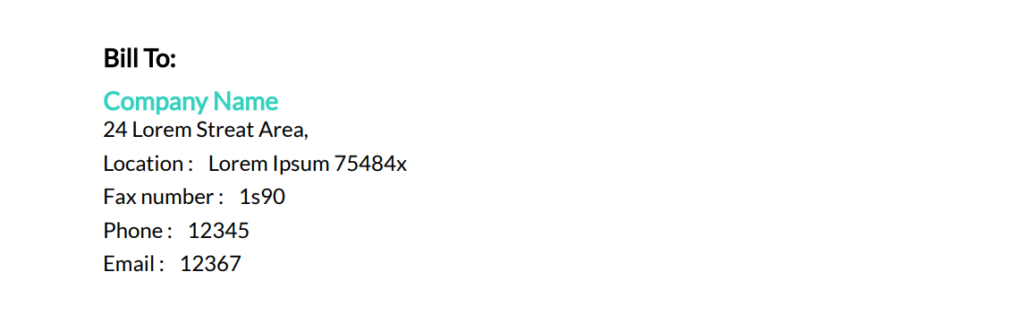

Billing information refers to the details required for billing and payment purposes in a transaction. This information typically includes the name and address of the customer, as well as the name and address of the seller or vendor. The billing information may also include contact details such as:

- Invoice number: The invoice number serves as a unique identifier for the invoice. The buyer and seller can easily reference and track the invoice throughout the payment process. This is especially important for businesses that handle large invoices, as it helps prevent confusion and errors.

- Phone numbers: Including the client’s phone number is important in invoices. A phone call can be a more personal and direct way to discuss any questions or concerns regarding the invoice or to follow up on the payment status. This can help to improve the client experience and build stronger relationships between the buyer and seller.

- Email addresses: It is essential for details like the client’s email address to be present in an invoice. Including an email address in billing information can be beneficial for several reasons. It provides an additional means of communication between the buyer and seller. In the event that there are any issues or questions regarding the invoice, both parties can easily correspond through email. This can save time and provide a record of the conversation for future reference.

- Fax numbers: Fax machines may seem like a relic of the past in today’s digital age, but they are still used by many businesses and organizations. A fax number is a telephone number used specifically for sending and receiving documents through a fax machine or online fax service. Including a fax number in your invoice is optional, it all depends on your preference.

Having accurate billing information is essential for creating and sending invoices, as it ensures that the invoice is sent to the correct recipient and that the payment is made to the correct party. It also helps to prevent errors or disputes that can arise from incorrect billing information.

2.3 – Description of services provided

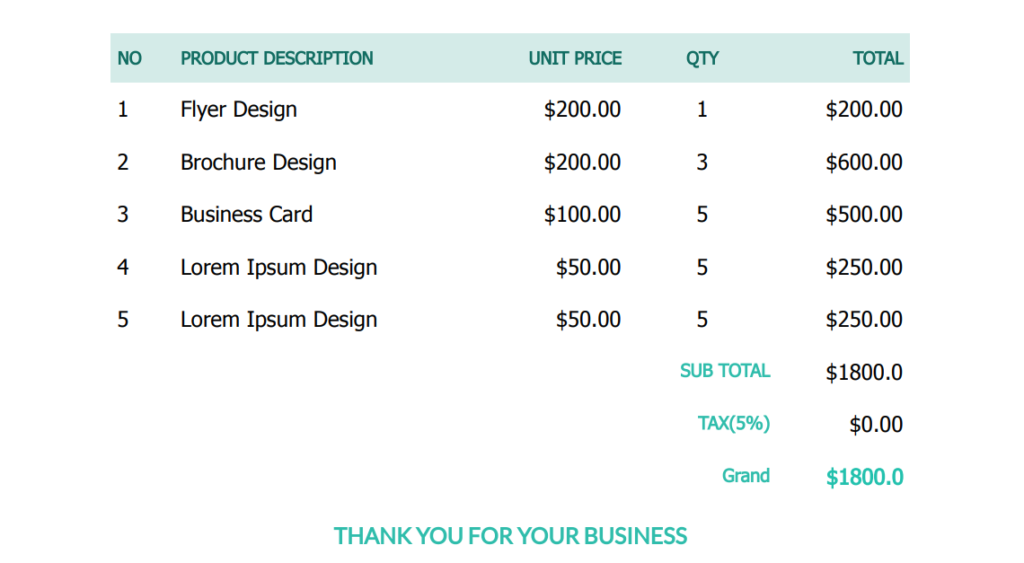

When creating an invoice, it’s important to include a detailed description of the services or goods that were provided, along with the quantity and price. This information helps to ensure that both the buyer and seller are on the same page when it comes to the details of the transaction.

The description of the services or goods should be clear and specific. It should include details such as:

- Name of the product or service: It is important to include the name of the product or service offered, any relevant part numbers or codes, and any other important details that are relevant to the transaction. For example, if the invoice is for a consulting service, the description should include the name of the consultant, the date and time of the consultation, and any specific topics that were discussed.

- Quantity of the goods or services provided: The quantity of goods or services provided should also be included in the invoice. This can be expressed in various units, such as hours, pieces, or gallons, depending on the nature of the transaction. It’s important to be as specific as possible when it comes to the quantity, as this can impact the overall price of the transaction.

- Price of the goods or services: The price of the goods or services should also be clearly stated on the invoice. This can be expressed as a unit price or a total price, depending on the nature of the transaction. If there are any discounts or promotions that apply to the transaction, these should also be clearly stated on the invoice.

- Taxes or fees: If applicable, any taxes or fees that apply to the transaction should also be included on the invoice. This can include sales tax, value-added tax, or any other applicable taxes or fees. It’s important to be accurate when calculating these taxes or fees, as errors can result in delays or disputes in the payment process.

A vital component of any invoice is the description of services provided. This detailed description provides both you and your client with a clear understanding of the work done and the associated costs. By including a detailed description of services in your invoice, you are giving your client a clear picture of the work that was done. This not only helps to avoid any misunderstandings or disputes but also reinforces the value of the services provided. It can also serve as a record of the work done for your own bookkeeping purposes.

2.4 – Include payment terms

Did you know that including payment terms in your invoice can significantly impact your cash flow and client relationships? Here are some of the things you need to know about including payment terms:

- Total amount due: As a business owner, it’s essential to communicate the exact amount that your client owes you to avoid confusion and delays in payment. Clearly stating the total amount due on your invoice will help your clients understand what they’re paying for and how much they need to pay.

- Payment methods: As a business owner, it’s essential to communicate the exact amount that your client owes you to avoid confusion and delays in payment. Clearly stating the total amount due on your invoice will help your clients understand what they’re paying for and how much they need to pay.

- Payment terms: Payment terms specify when payment is due and what happens if payment is late. It’s essential to establish clear payment terms with your clients to avoid misunderstandings or delays in payment. Your payment terms should include details such as payment due dates, late payment fees, and payment methods accepted.

Including payment terms, the total amount due, and payment methods accepted or a link to your payment portal in your invoices is critical for maintaining a healthy cash flow and building strong client relationships. By providing your clients with clear payment information and multiple payment options, you’ll make it easier for them to pay you promptly, ensuring that your business continues to thrive.

2.5 – Proofread before sending

Proofreading an invoice is a crucial step in ensuring that your business runs smoothly. A poorly written or inaccurate invoice can lead to confusion, delays in payment, and even damage your professional reputation. Here are some reasons why proofreading your invoice is essential:

- It helps you catch errors and mistakes: Spelling errors, typos, and numerical mistakes can all lead to confusion and delays in payment. By proofreading your invoice, you can catch these errors and correct them before sending the invoice to your client.

- It ensures that your invoice contains accurate information: An invoice with inaccurate information can cause delays in payment and damage your reputation. For example, if you provide the wrong quantity or price of goods or services, your client may dispute the invoice, leading to a strained relationship.

- It ensures that your invoice is professional and polished: Your invoice is a reflection of your business, and a poorly written or inaccurate invoice can make you look unprofessional. By proofreading your invoice, you can ensure that it is error-free, well-formatted, and easy to understand.

3. Best Practices for Invoicing

As a business owner, invoicing is an essential part of your operations. It’s how you get paid for your goods and services, and it’s important to do it right. However, with so many things to consider, it’s easy to get lost in the details and end up with a messy, inefficient invoicing system. That’s why it’s crucial to follow invoice best practices.

Not only will following best practices help you avoid costly mistakes and delays, but it can also make your business look more professional and efficient. By presenting clear, accurate invoices that comply with legal and accounting standards, you’re demonstrating your commitment to excellence and building trust with your clients.

But what are these best practices, you might ask? They can include everything from using standardized invoice templates to include detailed descriptions of your products or services. It’s important to tailor your practices to the specific needs of your business, here are some universal guidelines that every business should follow:

3.1 – Clearly label invoice

One of the most important things to keep in mind when creating invoices is the importance of clear labeling. While it may seem like a small detail, properly labeling your invoices can make a big difference in terms of efficiency, accuracy, and professionalism.

This ensures easy identification of invoices. When you’re juggling multiple invoices for different clients, it can be easy to mix things up. Proper labeling helps you quickly and easily identify the invoice you need, saving you time and reducing the risk of errors.

Clear labeling is also important for legal compliance. Depending on where your business is located, there may be specific requirements for what information must be included on an invoice. By labeling your invoices properly, you can ensure that you’re in compliance with the law and avoid any potential legal issues.

3.2 – Include all necessary details

Including the right information in your invoices provides clarity for both parties. By adding key information like the invoice number, phone number, email address, date, and billing information, you’re setting clear expectations for what needs to happen next. This can help prevent disputes and misunderstandings down the line, as both parties know exactly what they’re agreeing to.

This makes it easy to keep track of your invoices and payments. For example, with an invoice number, you can easily identify and match the invoice to the corresponding order or contract. This can help prevent confusion and ensure that the right invoice is sent to the right recipient. Also, adding details such as the date when the invoice was sent helps to establish a clear timeline for payment and makes it easier to track payment history.

3.3 – Provide payment terms

Adding payment terms to your invoices is an important aspect of invoicing best practices. Payment terms refer to the specific conditions under which payment is due, including the due date, payment method, and any applicable fees or penalties.

Including payment terms on your invoices helps to establish clear expectations and prevent misunderstandings regarding payment. By providing specific information about when and how payment should be made, you can help ensure that both parties are on the same page.

Also, having clear payment terms in place can help you manage your cash flow more effectively. By knowing exactly when you can expect to receive payment, you can plan your finances more accurately and make better business decisions.

3.4 – Be professional

A professional-looking invoice reflects positively on your business and helps to establish credibility with your clients. It shows that you take your work seriously and that you value professionalism and attention to detail. A well-designed and organized invoice can make a positive impression on clients and contribute to building a strong and trustworthy business reputation.

Also, being professional when creating invoices is a legal requirement in many jurisdictions. There may be specific legal requirements for what information must be included on an invoice, such as your business name, address, and tax identification number. By creating a professional-looking invoice that includes all the necessary information, you can ensure that you are in compliance with any relevant laws or regulations.

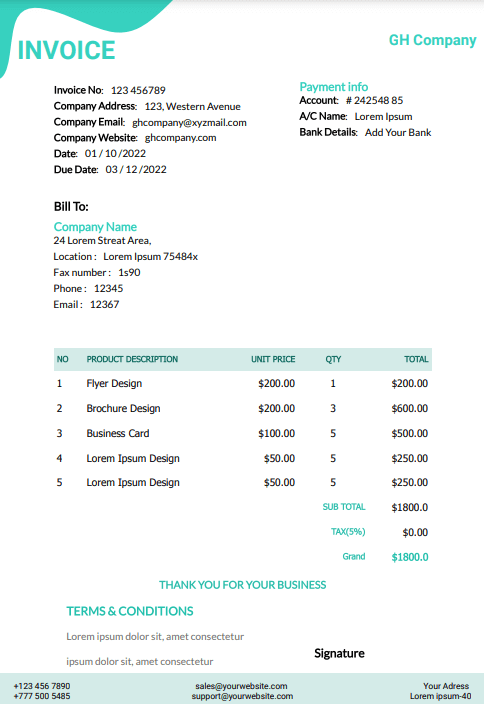

4. Designing a professional invoice using APITemplate.io

APITemplate is an API-based template that provides users with a flexible way of generating documents or images such as social media images, and PDF documents like invoices, reports, forms, and many more.

The great thing about APITemplate is that you don’t have to customize your documents from scratch, instead, there are a variety of pre-designed templates that can be customized using a simple drag-and-drop editor like the What-You-See-Is-What-You-Get (WYSIWYG editor), making it very flexible for developers to create visually appealing templates. It’s okay if you aren’t familiar with the WYSIWYG editor, we have a tutorial covered on the introduction to the visual editor, and how you can use it to create PDF documents.

In addition to the template editor, because APITemplate is a cloud-based API, it provides flexibility to create PDF invoices from an HTML template using your most-preferred programming language. You can learn how to do that here. Awesome right?

Here are the easy steps to design a professional invoice using APITemplate:

Step 1 – Sign up for an APITemplate account

If you have a registered APITemplate account, then you can skip this step, but if you don’t, go to APITemplate, click on the Sign Up button at the top of the page, and follow the necessary details required to create your account. I’m sure you may be wondering, can I sign up for a free account and still get to use all the templates for free without having to input your credit card details? Yes, you can! You can also sign up for one of the paid plans for great premium features.

Step 2 – Go to “Manage Templates”

After your registration is complete, you would be automatically directed to your dashboard. Go to Manage Templates which is located at the top section of the page. The Manage Templates page contains all the templates you would be creating and using on APITemplate. On this page, there are two options to choose from: New PDF Template and New Image Template. Since the goal is to create a PDF invoice, we would be selecting the New PDF Template.

Step 3: Select New PDF Template

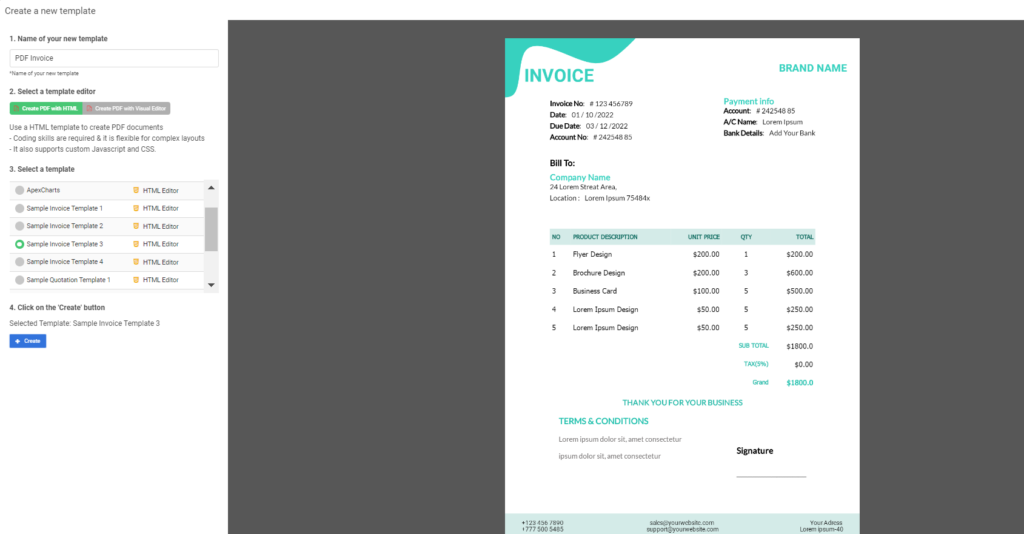

On the New PDF template page, you would be directed to a page where you can create a new template. Here, you would see the different types of PDF templates available on APITemplate. You can choose to change the name of your template if you like using the “Name of your new template” field (I renamed mine to PDF Invoice). It’s alright to leave the default name too.

Go to the “Select a template” field, and choose the Sample Invoice Template, we have the option of choosing which Invoice best suits our needs, either the Sample Invoice Template 1 or 2 or 3 or 4. After selecting the Sample Invoice template of your choice, click on the Create button. Now, you can start customizing your template to fit your specific requirements. APITemplate provides a user-friendly interface that allows you to edit text, add images, change colors, and adjust other design elements easily.

Step 4: Integrations

We integrate with Zapier/Make/Bubble and also provide REST API for PDF generation.

Find out more about integration tutorials at our blog

5. Conclusion

Invoicing is an important aspect of running a successful business. Creating professional-looking invoices is essential for establishing credibility, avoiding payment delays and disputes, and complying with legal requirements. By following best practices for creating invoices, you can ensure that your invoicing process is efficient, effective, and professional.

When creating an invoice, it’s important to include all the necessary details such as the company name, address, email address, and invoice date. You should also include a detailed description of the services or goods that were provided and the payment terms and conditions. By following invoicing best practices such as clear labeling, providing payment terms, and being professional, you can ensure that your business runs smoothly and that payments are made promptly.

With PDF generation services like APITemplate, you can create professional-looking invoices with ease using pre-designed templates that can be customized to fit your specific requirements. Simply follow the steps outlined above to design an invoice that perfectly reflects your brand identity and saves you time.